Thread replies: 142

Thread images: 20

Thread images: 20

Anonymous

Debt is GOOD, Deficit is GOOD 2017-07-01 12:28:00 Post No.

[Report] Image search: [Google]

Debt is GOOD, Deficit is GOOD 2017-07-01 12:28:00 Post No.

[Report] Image search: [Google]

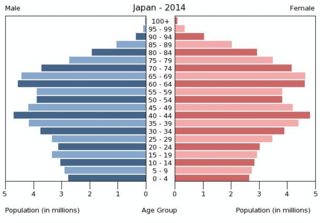

File: sector.jpg (93KB, 576x394px) Image search:

[Google]

93KB, 576x394px

Wake up sheeple

Government debt = Private sector savings.

This is always true. High government debt is not a bad thing, it just equals the amount of savings of families and companies.

Zero government debt means no one can save and have money in the bank.

Every single printed dollar is government debt. You use government debt to pay for coffee.

Stop believing that government debt is bad please. (Google Modern Monetary Theory )

>>

Please understand this, no matter what party you vote for. If they tell you they want to reduce debt they are idiots.

It just means reducing private wealth, basically taxing more so that all the money the state has printed (=debt) will be destroyed.

Politicians reducing government debt are NOT doing your best interest.

As long as there are unemployed people, increasing debt (=creating more money) is good as long as it is used to employ more people and produce more

>>

>>131948352

>This is always true

Only if its used for necessary public services creating value or to drive demand and create value somewhere along the way.

If it's funding dead-end programs or useless government inefficiency shit it's just money being shifted around or taken out of yours or the private sectors wallets and burned for zero return.

>>

>>131950139

well that equation is mathematically always true, it's basica accounting. Every single minus in the goverment balance corresponds to a plus in the private sector balance.

But what you are saying is somewhat true, that is, if the goverment increases debt a lot but basically wastes the money instead of using it to do productive things, then the private sector will indeed have more money, but that money will be worth less, cause there would be more inflation.

So yes, if the goverment increases debt by 1 trillion by giving it all to one random person, the private sector will be 1trillion richer, but when he spends that money dollars would lose some value due to inflation.

But if the goverment uses that money to pay for people to do productive jobs (like building infrastructure or factories and whatnot), then the real wealth of the country will be increased.

The optimal amount of government spending is such that every person who wants to work can work, so that maximizes REAL production of goods and services, and the real wealth of a nation.

>>

>>131948352

Dumb wop.

Money IS debt

That's why the graph is symmetrical

>>

>>131951341

Exactly. Money is debt, every single dollar around represents debt.

If debt goes to zero, money supply goes to zero, so there would be no more money in the economy and no one could save a single dollar.

So people who believe that we should reduce government debt are completely retarded and don't understand anything about money.

Reducing government debt equals reducing private savings.

>>

People only believe in money when they don't have it

>>

>>131951675

It's almost like he monetary system is flawed.

If all money is debt on which interest must be paid please tell me how this system is sustainable

>>

>>131951758

what do you mean

>>

File: retard.jpg (8KB, 375x375px) Image search:

[Google]

8KB, 375x375px

>>131948352

>Rapid inflation is good

>>

>>131951675

Well in that case the US economy is doing enormously well considering the debt now exceeds total GDP

>>

>>131948352

Everyone knows that proceeds from borrowing are reinjected into the economy.

The problem with a too high debt to GDP ratio are:

1) It increases the marginal cost of funding (so it's a self-reinforcing cycle) as it increases the probability of default or the inflation forecast (diminishing expected return so investors require higher interest rates)

2) If floating rates, it exposes the country to interest rate risk

What this means is that the day there is a downturn, the country is more vulnerable because refinancing or paying interest on existing debt is unaffordable. The government is forced to reduce spending, or increase taxes, or print money, all of which have adverse effects on effects on the economy.

It works exactly the same as personal loans.

>>

>>131951868

Yes, long term, the natural interest rate should be zero, or close to zero, otherwise we will either need to print money exponentially to pay for existing debts, or, if the money supply isn't increased at the state level, everyone would have to become slaves of banks to pay interest on their debt, that can only be canceled by direct work for the bankers, since there is not enough money in the system to pay for all interest.

Thankfully, interest rates are naturally going down, as the growth of economies in western nations is also slowing down.

>>131951940

>Rapid inflation is good

Actually, most western countries are now in a situation of almost 0 inflation or deflation, despite the high debt and money printing.

As long as the printed money is used in productive ways, inflation would not be a problem. Plus some amount of inflation is desired cause it's an incentive to spend money faster and make the economy go round, increasing sales and production.

>>

>>131948352

Il post più ebraico su /pol/

>>

>>131952672

>the natural interest rate should be zero

It can't be zero. This would mean that people are indifferent between receiving $1 today and $1 in the future.

But you maybe meant the inflation rate, in which case I would agree in the very, very long term.

>>

>>131952610

Debt is only a problem for countries who don't have their own currency, or try to peg their currency to foreign currencies (like argentina and zimbabwe tried to peg to the dollar and failed, or like the eurozone countries, who also gave up their monetary policy power, by basically "pegging" their currency to a virtual foreign currency called euro).

The probability that a country defaults in debt denominated in its own currency (which the country can print indefinitely) is ZERO, it's a fact.

Countries with a sovreign currency don't actually need bonds to finance themselves, it's just another fancy way to insert money in the system (and increase the private sector's savings). Countries with a sovreign currency don't need bonds, it's just an heritage from when currencies were pegged to precious metals. Now sovreign countries can just print the money out of nowhere, as long as they have control of their currency and it's not pegged to anything.

>>

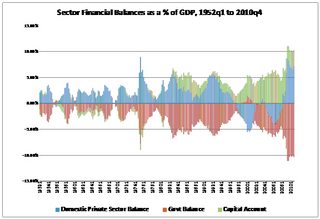

File: IMG_0643.png (21KB, 662x394px) Image search:

[Google]

21KB, 662x394px

>>131952672

Low interest rates encourage people to take out more loans which causes inflated bubbles

The U.S is already in the midst of an auto loan, student debt, credit card and housing bubble just like in 2007

All the while the US kept packing on debt because it spent more money than it actually had which means paying off the interest on the debt is gonna get pricey everywhere

Pic related shows just how expensive it was in 2015

>>

>>131948352

You're mostly wrong. American debt is not good or bad, ever since we got on fiat currency we have been a debt based economy. At this point in time there is no way we will ever pay back our debt, there isn't enough real money in the world.

>>

>>131953342

>The probability that a country defaults in debt denominated in its own currency (which the country can print indefinitely) is ZERO, it's a fact.

That's actually wrong. As surprising as it seems, check it out on google, sovereign country have defaulted on local currency denominated debt. That's because the political costs of inflation were deemed worse than default.

>Countries with a sovreign currency don't actually need bonds to finance themselve

They do because printing money doesn't create real value (or very few if some prices are sticky). If the money supply increases by 10% and prices by 10%, it doesn't change shit.

>>

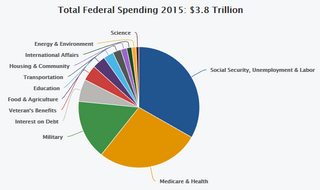

File: price index.png (14KB, 731x379px) Image search:

[Google]

14KB, 731x379px

>>131952672

>Actually, most western countries are now in a situation of almost 0 inflation or deflation, despite the high debt and money printing.

You're literally just making shit up

>>

>>131948352

I get what you're trying to do.

You are arguing against your beliefs in order to debate the other side

>>

>>131948352

What if the debt is held by foreign entities?

>>

>>131952960

yes i dont think it can reach zero, just get closer and closer to it.

Of course interest rate and inflation go hand in hand. An interest rate of 20% in a setting when annual inflation is 20% means 0% interest rate in *real* terms.

But there can be settings where people are actually willing to loan money for even negative interest rates (believe it or not, as absurd as it is, it's actually happening right now, european banks are loaning money for negative interest rates). For example, if the central bank enforces negative interest rates, so all bank deposits basically lose money at a certain rate, you could have an incentive to loan that money at a rate that is zero or slightly negative. But that's an extreme case.

>>131952773

zitto, frocio

>>

>>131951675

Decreasing the money supply is good for people with savings.

>>

>>131954207

Vai a scopare Eva, serpente

>>

>>131948352

This is because our fiat currency debt-slavery system relies on debt for growth. This situation is undesirable and is not possible to maintain permanently.

>>

>>131954207

Fisher effect:

(1 + Nominal interest rate) = (1 + inflation rate) * (1 + real interest rate)

The growth in the money supply (thus the inflation rate) should follow to the growth of the economy - and yes, in the very, very long term it's 0%. But the real interest rate will always be above zero because of time preferences.

Some investors buy money with negative interest rates for the following reasons:

1) They have a mandate and have to buy some types of bonds even with negative yields

2)They speculate that the central banks will buy the bonds

3)They speculate on currency movements (hence many investors are ready to invest in safe haven currencies even at negative yields)

Of course if 1, 2, and 3 didn't exist no one would buy bonds with negative yields. It's like throwing money out of the window.

>>

>>131954163

in our case (u.s.) that's less than ~15%

we hold most of our debt unlike say greece, turkey, or all of africa

>>

>>131953420

all that matters is *real* goods and services that are being produced. As long as production is maximized, real wealth is maximized. The amount of debt or bubbles is insignificant, that's just accounting. Even if the bubble explodes and no one pays their debt back, nothing bad happens, as long as the government responds to it by putting enough money in the system quickly.

>>131953631

there's no limit to human stupidity. You can do whatever you want if you have your own currency, if you want to default on debt, sure. You can even repay that debt in the old currency and start using a new currency or whatever, it all depends on the specific terms of the bonds which can be quite different at times.

>>131953634

Global inflation rates have generally been going down:

http://data.worldbank.org/indicator/FP.CPI.TOTL.ZG

US inflation rate is still decent but not particularly high either:

https://fred.stlouisfed.org/series/FPCPITOTLZGUSA

And inflation in other western countries like europe and japan especially, has been zero or even negative in recent years.

>>

>>131954808

You don't have to be offshore to be foreign.

And you don't even have to be a non-citizen.

You just have to hate white people.

>>

>>131954163

In that case you technically "owe" them something. But it's denominated in your own currency, so you can do whatever you want basically. Its better to have real goods than currency, cause holding currency of which you dont control supply is risky.

For example, the US imported a lot of REAL goods from china, so that's REAL welath right there. China instead, is not holding a lot of us dollars and us debt. As long as dollars dont depreciate too much and the us doesn't default on debt, they can be somewhat happy with it. But otherwise the'll be fucked (and may or may not go to war for it or something).

In general, importing is better than exporting, cause with imports you obtain real goods, with exports you obtain foreign currency which is always risky.

>>

>>131954217

True, that's why the jews in power who control the media want you to believe that government debt is bad. So all the money they have in their jew-banks will be worth more and more thanks to deflation, and they will hold a larger % of the global wealth.

Good Goym

>>

>>131954717

>Of course if 1, 2, and 3 didn't exist no one would buy bonds with negative yields. It's like throwing money out of the window.

yes, i agree.

>>

>>131955055

>Even if the bubble explodes and no one pays their debt back, nothing bad will happen

Except a downgrade in their credit rating, defaulting on loans or printing more money which leads to high inflation

Look at Illinois right now. They couldn't pay off their massive debts which means they've been downgraded to junk status which means it's gonna be much more difficult for them to attract investors or take out more loans to pay off their workers

This is happening in numerous states

and the consequences will be catastrophic

>>

>>131950014

Burn down your house so you can build a new one, goyim. Debt is good for you.

>>

>>131955418

This would be true if high inflation didn't have an impact on the real economy.

Inflationary spiral:

> Prices go up very quickly

> Higher costs of livings increases wages

> More demand as everyone spends now, since everyone has higher wages and expects prices to keep going up

> Prices go up etc.

> Meanwhile no one saves anymore, interest rates skyrocket and long-term projects (e.g. innovative companies, buying a house or a car) can't be funded; also, bond holders and previous savers are killed in the process (their savings aren't worth a dime anymore)

>>

>>131956090

>interest rates skyrocket

Note: I mean they go up much quicker than inflation itself because of the expectation that inflation will keep going (since inflation reduces the value of fixed payments)

>>

>>131951341

No, smart wop.

Money IS debt.

Money IS credit.

Hence the graph is symmetrical.

No debt, no credit, no credit, no debt. No money.

>>

>>131948352

>government debt is good because it saves money for corporations

>by shifting the debt from those corporations onto citizens

>>

>>131948352

True for countries if the debt is equal. Fiat represents promises.

>>

>>131948352

Babby just learned about MMT. Congrats. Now grow up and realize this does not mean more gov debt=richer private sector. WHY? Because your chart is % of nominal gdp. Says absolutely nothing about real growth or wealth.

Seriously i think u should be underage b&

>>

>>131951341

Money is not debt under normal circumstances. It's a simple mean of exchange.

Because of fractional reserve bankin (banks creating money by lending your deposits), some, but not all of the money supply is actually debt (from the banks to depositors).

>>

File: banking.jpg (2MB, 2004x2720px) Image search:

[Google]

2MB, 2004x2720px

>>131950014

>>131948352

>>131950804

>>131951675

You are so deluded. Explain this then.

>>

File: 1495012803239.jpg (15KB, 300x295px) Image search:

[Google]

15KB, 300x295px

>>131948352

Fuck off

>>

yep - this post is obviously a joke

haha

>>

What is quantitative easing?

>>

>>131956090

I agree that very high inflation rate is not nice, but mostly because it's uncomfortable.

In practice you could live with an arbitrarily high inflation rate, it's just uncomfortable cause everyone would always have to immediately convert their currency into something else.

There can be policies to make high inflation more "liveable", for example in italy, when we had high inflation in the 60s, salaries by law were automatically adjusted for inflation month by month, or Brazil for example introduced the "REAL" as a unit of measure to replace their highly inflationary currency.

Tbh a state who controls money supply, can always set arbitrary inflation or deflation depending on how much they choose to print and tax. Historically, problems of hyperinflation were always due to exogenous cases, like big swings in the price of oil, or debts that were to be repaid in foreign currencies or gold.

Of course if you are a shitty country who doesnt produce anything other countries want, and you need to import oil or something like that, you can run into problems, but that's not something related to monetary policy.

> Meanwhile no one saves anymore, interest rates skyrocket and long-term projects (e.g. innovative companies, buying a house or a car) can't be funded; also, bond holders and previous savers are killed in the process (their savings aren't worth a dime anymore)

Interest rates go hand in hand with the inflation, so its not really a problem, the *real* interest rates would still be reasonable. Of course it's a problem if you sign a contract with a fixed interest rate when the inflation is high, and then inflation goes down so you end up having to pay more in real terms (that happened to many southern european countries).

The fact that previous savers are killed in the process could actually be a good thing sometimes for some more fair redistribution of wealth.

Anyway I agree that high inflation is not nice.

>>

File: 1495132699696.jpg (198KB, 990x720px) Image search:

[Google]

198KB, 990x720px

>>131948352

>Virtually inflating the money supply while physically keeping it at the same volume is a good thing

>>

>>131957464

The central banks buys bonds in large quantity, and not only short term government bonds but also long term and corporate bonds, in order to stimulate the economy by pushing down interest rates.

It is an extreme measure only done when policy interest rates / short term rates are at zero or close to zero but the economy still needs stimulus.

>>

>>131957964

Note: normally central banks buy only short term government bonds in short quantities, it's called "open market operations (OMO)", and is one of the three conventional monetary policies (while QE is unconventional) in this case.

>>

>>131956968

Not true.

Money is credit in the sense that it denotes that you are owed a certain value of goods and/or services etc..

but credit can only be given by also creating debt. If you are owed that much, then you are owed it by someone... in this case it's the rest of the nation that operates on that currency.

Think of that part like company vouchers. You get paid in company vouchers. The company owes you that much in goods at the company store...

Exchanging money is exchanging credit and debt.

>>

>>131956990

tl;dr

>>131957464

a central bank program to buy government bonds. Basically the government loaning money to itself. It's pretty useless and makes it clear how silly the bond system is.

>>

>>131957964

Then why has this emergency policy been on going since 09/10? It creates more money, devaluing current money by making it less scarce. Theft via inflation.

Central banking is a Ponzi scheme, if you don't understand this (and I know you do cos you're not stupid) you're either deluding yourself or playing devil's advocate to get (you)'s

It's a scam.

>>

You need a growing population for this model dipshit.

Why do you think they pump in immigrants.

>>

>>131958206

Bang on, cryptos will hopefully replace this fucking mess. Blue pilled (((degree in economics))) goys will hopefully come to terms with this some day

>>

>>131948352

>This thread is located right next to an Illinois thread in the catalog.

Priceless.

>>

>>131958187

>Money is credit in the sense that it denotes that you are owed a certain value of goods and/or services etc..

Credit is when someone (your debtor) owes you a payment and you can claim it later. With money, the exchange is simultaneous and you cannot "force" anyone to sell you something (if it's a for sale item with a price on it yes but that's because they decided to sell in the first place). So it's best defined as a mean of exchange.

Money created by fractional reserve banks is debt because they owe the money they create and lend to their depositors, who can claim it when they withdraw.

>>

>>131958187

this guy gets it. Money is just a measure of account of credit and debit. The amount of """money""" in the system equals the amount of total debit (and total credit).

Of course it's virtual and potentially infinite, just like points in a game of basketball.

>>131956968

what you are saying is partly right.

The amount of money in circulation is all debt.

Part of it is government debt, and that is the only way to insert "net" money into the private system. Then, due to fractional reserve banking, the total amount of money in the private sector can be increased through private bank loans, that does NOT increase the NET amount of money in the private sector, because both the credit and debit part of the loan are in the private sector, but still, it can increase the punctual amount of "money" in circulation at a given moment.

The majority of "money" around (about 97% i think), is actually "created" by private banks through loans.

>>

>>131958210

The end is coming I think. In the US they haven't been doing it for years. In Australia not sure, I think you have good growth so not sure they have even done it.

I'm just explaining the logic, I don't necessarily agree. I don't entirely believe in equilibrium (that markets will sort out and reach optimum with no intervention) but a lot of central banking decisions can be questioned and some of them lead to the bubble and burst cycles.

>>

>>131958210

everything is a ponzi scheme on a long enough timeframe

>>131958376

no, sorry but you're an idiot. Cryptos will never replace a real currency. A real currency needs a central entity baking it who can do monetary policy and enforce price stability. Cryptos will never be stable in price and thus not a good currency. They are more akin to gold, and we stopped using gold as a currency a long time ago and for good reasons.

If you use something as a "currency" which is in a limited fixed amount, you are just crippling your economy and limiting your growth, also likely going into deflation and creating huge welath disparities.

>>

>>131959250

>for good reasons

fuck off shill

>>

>>131958815

Yes, but you also have a claim on the system. It used to be in gold.

It's the bond that holds an economic community together. You wouldn't accept money as payment if you believed that no one in your country would accept it afterwards.

>>

>>131958856

>Part of it is government debt

I disagree with that. It's a detail since generally most of the money is created through fractional reserves, but you can't claim anything from the government against your € or $ since there is no gold standard. If you can't claim anything it's not debt.

>>

>>131959621

Yes, with gold standard I agree. Now fiat currencies aren't backed by anything, so you can't claim anything.

>>

>>131959250

No u r, I hope you're getting paid for this shit

>>

>>131959250

>Cryptos will never replace a real currency

True. And there are a lot of risks (legal, technological, cyber, competitive). Those who buy and hold cryptos (especially cryptos not backed by real assets - some are backed by precious metals or real estate or shares in companies) will be killed the day the bubble bursts.

>>

>>131959544

sorry dude, cryptos are great, but they are not a viable currency for a proper state. The goal of a currency is price stability, and its supply should reflect the growth and needs of the economy.

Cryptos are too volatile to be used as a proper currency, ever.

>>131959640

The value of a currency (at least according to mmt), is due to the demand for it. And the main demand for a certain currency is taxation in that currency.

So when you say $ are not backed by anything cause there is no gold standard, i say they are actually baked by taxes and government power.

The government requires you to pay taxes in dollars or theyll put you in jail with force, so that's what bakes the value of dollars. What you can "claim" from the government by showing them your dollars, is the ability to not be put in prison.

>>

>>131960258

You're countering your own argument.

>Shouldn't be backed by something tangible, but it is backed by something tangible.

Why are u so invested in scam economics? Are u a jew?

>>

>>131960258

Cryptos are only good (and should be used) for transactions that you want to keep secret. Otherwise, there is no value added.

>>

>>131960902

i said it shouldnt be baked by something finite, not tangible.

If its baked by a finite resource, it is bound to swing a lot in value. Being backed by government imposition through force is a different thing.

>>

>>131961046

true, they're nice for hiding money and transactions from the government. I think that's the main market for cryptos, illegal operations of any kind, and avoiding capital controls

>>

>>131961297

Backing means that it corresponds directly to another value or is redeemable in that value. It's not the case with fiat currencies.

The fact that fiat are the only legal tender guarantees that there will always some demand for it (although in extreme cases - like hyperinflation - people might use cryptos instead but we're still very far from it, most people don't even know cryptos).

>>

File: 1498236462656.jpg (23KB, 208x217px)

23KB, 208x217px

>>131961297

Force is limited and an illusion, that's why your country is run by the Mafia, not the gubberment.

The cops will take more and more bribes as the purchasing power of their Fiat salaries (latin for salt, not paper) tapers off which effectively is a debasement or inflation on the amount of force that can actually be applied.

No matter which way you cut it, I'm right and you know it. Ama

>>

>>131961539

What is, the Cyprus banking fiasco of a few years ago?

And how did it effect the price of btc?

>>

>>131961782

I'm not sure for Cyprus. But I know that in the case of Greece Bitcoin went up (not sure if because of Greeks though).

>>

>>131961918

You and I both know what the Greece crisis was about, otherwise we wouldn't be posting in this thread, right?

Google it, it's worth learning. Particularly if you want to have more Fiat money in your account.

>>

>>131962191

what was the greece crisis about according to you?

>>

>>131959767

Of course you can though, practically speaking.

>>

>>131962191

I don't have any money to invest right now anyway.

But if I had, I would put 90% of my money in ETFs (conservative baskets of bonds and equity). If you diversify the geography of your assets (especially if you do so that you replicate the currency exposure of an SDR) you have better protection than with cryptos.

For the remaining 10% I might invest in speculative assets in a "lottery" fashion. Cryptos are in this category. If a real good one comes out (with superior technology, partnerships and downside protection) I might invest. But at the moment there are a lot other options that I find more attractive using derivative contracts.

I'm not against crypto at all, but buying and holding with 100% of your savings is very, very risky.

>>

>>131962644

What can you claim from the Canadian government with 1 CAD?

>>

>>131955530

>more debt

>makes your money worth more

>need more to pay it off

>it's all nothing but an interest payment

Go to bed

>>

>>131962799

Bitcoin was $7 in 2010, do you think it'll go down to that price again?

>>131962555

Saving the euro currency at the expense of Greek sovereignty, next question!

>>

>>131962799

>better protection than with cryptos

Here I'm speaking about pure currency hedging of course. Cryptos are also contracyclical in general (but for that gold or short ETFs are even better).

>>

>>131958206

>>131956990

You expect people to read your deluded crap but won't read a rebuttal?

>muh echo chamber

>>

>>131963031

Just gotta reply to the epic truth bomb I dropped, $7 to $3000 and climbing in 7 years.

Wew lad, them gainz! Especially for a lottery meme asset

>>

>>131963031

>Bitcoin was $7 in 2010, do you think it'll go down to that price again?

I don't know the fundamental value of a bitcoin so it's difficult to say. I find this doubtful if BTC remains the top crypto even if all cryptos go down. But if BTC falls out of favour because everyone switches to ETH or LTC (say, after a ban of BTC in particular or if a mafia takes control of BTC which the creator admitted is possible in the Whitepaper, or for whatever reason), it can even go to 0. This is the problem with cryptos, they don't only have the classical currency risks but also legal, cyber and competitive.

>>

>>131963193

They Jewry is off the charts eh

>Have faith in Fiat goy!! Otherwise our (((plans))) will fail, don't you like your melting pot!? Don't you want your 9-5 job?

>>

>>131948352

You make the incorrect assumption that central banks are owned by governments. In many countries, particularly the Western world, this is not the case. For instance, the Federal Reserve of the United States is not an actual government agency, but a private corporation owned in large part by the Rothschilds. When you owe $20 Trillion to people, they start making demands, and you are no longer in control of your nation.

As to your government debt = private sector savings, this is never true. Government debt is backed by taxes. They may be taxed on the next generation, and not yourself - but it's hardly savings. They're taking YOUR money and paying themselves, often to do shit you don't really want, and rarely ever need.

True wealth is in the production of goods and services, which is an ever decreasing portion of Western GDPs.

>>

>>131963193

That's not a rebuttal, leaf. You posted an image and you expect him to formulate your argument for you out of it. How about you use the information in your graphic to formulate your own argument?

>>

>>131963362

But in the last 7 years, would you say btc was a better or worse investment than real estate, gubberment bonds, blue chip stock?

Just on performance, not rhetoric cos any statement questioning the viability of btc by default applies to fiat

>>

>>131963031

>Saving the euro currency at the expense of Greek sovereignty, next question!

good answer

>>131962876

i just said the contrary. Less government debt means less money in circulation so money will tend to appreciate (deflation). And this favors the people who are already rich (jew bankers).

Furthermore, with deflation and not enough money inserted in the system to pay back interest, regular people will fail to pay their loans back so jew bankers can obtain all their *real* assets, and force them to work for them as slaves.

The jew propaganda has been very good in making people believe that government debt ("our collective debt!") is a bad thing. It's actually a good thing for the average person. It's bad for the jewish bankers.

Good goym.

>>

>>131963540

Right now it may be worse, as US legislation pending will make it extraordinarily unattractive to use here - and of course the other countries in the Western world will follow. Same will apply to Etherium as well. Federal Reserve guys are naturally unhappy at the competition.

>>

>>131950014

Best way to reduce debt is by paying it off.

Sadly it's in the left's interest to only build more debt, so they can put everyone in debt-assistance programmes that only serve to fatten the state some more.

>>

>>131963540

For absolute return, yes bitcoin was much better. But it was also much more risky (as measured by the volatility of the price) and still is. This is why personally, even if I was willing to bet on BTC, I would do it with only a fraction of my savings: if it goes up it's still a nice return, if it goes down at least I'm not bankrupt.

>>

>>131955780

What Mario is getting at is that Illinois can't print dollars.

>>

>>131963776

They legislate against cocaine too, but I'm bullish on cocaine being in fashion next year too.

This is the gradual reversing of gubberment power, they can say whatever they want but enforcement is another question entirely.

Take Australia for example; guns are illegal, but we also have a illegal gun problem cos there's guns everywhere.

Would more gun regulations and banning change this trend? Or would more of the same result in more of the same..

>>

>>131963443

mm thats just like, your opinion man. The fed can be considered a government entity, it is created within the legal system of the government and the government gives it its mandate. Technically yes, private bankers sit on the board of the fed, but that's just because the government decided to make it so. In practice, the fed is a branch of the government.

Its true that real wealth is the roduction of goods and services. I of course agree on that.

Your sentence that its not savings but will go away with future taxes, is actually false.

Of course a government could eliminate their debt by taxing all the population at 100% and removing all the money from the economy, that's the only way to pay back all debt. But of course that will never happen cause no government is stupid enough to do something like that. The entire economy would collapse.

Sovreign countries don't pay their debt back in its entirety and wont tax the population in order to do it. It would be suicidal.

>>

>>131963703

If we had no dollars AND no debt we still would need to pay the interest. More debt means more interest means more dollars. If we ignore it and pay it off or make more we're fucked either way. Nobody has any clue what you're talking about. You're just talking lots and shilling hard. Kikes love usury. And interest. Nothing else makes any sense. You make me tired. It is 5 in the morning in italy. Go to bed

>>

>>131964309

The fed has private shareholders youre not allowed to know who any of these people nor boards are. The fuck are you talking about "in practice is government"? They dont lobby? Don't reply im gone and not reading this shit

>>

File: 1496925861476.jpg (136KB, 778x682px)

136KB, 778x682px

>>131964050

You're really missing the point here, if you bought 10k worth of $7 btc in 2010, and forgot you owned it till just now, you'd be a millionaire in fiat currency suddenly.

Worry is in the eye of the beholder, buy and hold nigga, you won't regret it. Post this pic back to me in $7 with your initial invested amount in cryptos vs how much it's grown since.

You can name your first born son 'bruce' to honour this day. Don't waste the money putting him through college either, send him to Australia to be a mad cunt. Your dynasty starts here.

>>

>>131964177

yup. If illinois could print dollars it would be different. Its always a problem when you are in debt in a currency that you do not have control over

>>

>>131964309

It is not my opinion, it's a fact. Federal reserve is owned by a number of regional banks, which are owned by the Rothschilds, as well as some other unknown investors. Aside from the honor of appointing a figurehead, which is really just there for appearances, government doesn't really have anything to do with the Fed.

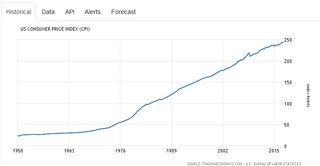

The economy wouldn't collapse if government paid it's debts, and there's no reason to suspect it would. You just don't tax people at that rate - you clamp down on government spending, and encourage economic growth of the private sector through reduction in taxes. The opposite however is true - a government that can't pay its debts, or becomes overburdened with debt does have a massive negative impact on an economy. See Japan, which after switching policies of balanced budgets went into extreme debt mode, thus stagnating their economy for a couple decades now.

>>

>>131948352

Found ZeroHedge's MillionDollarBonus_. Excellent bait as always.

>>131951868

>It's almost like he monetary system is flawed.

Flawed in (((their))) favor, of course.

>>

>>131964216

Problem is that in order to make bitcoin worthwhile, it needs to gain general market adoption. Otherwise, it becomes that currency that criminals use, and it's value (and growth) becomes pretty limited, and it goes back to values we saw before. Much of the growth in the past couple years was due to what appears to be some growing market acceptance - which is in jeopardy now.

>>

>>131963443

Wow, I sure do know I'm in /pol/

>>

File: 1495013503032.gif (174KB, 380x165px) Image search:

[Google]

174KB, 380x165px

>>131965428

It's never been accepted, and criminal use is what keeps the USD in vogue too. Oil, drugs, war.. all paid for in USD.

It'll inevitably climb in value cos the literal number of USD is circulation is climbing by the second. It's market forces in that sense, more scarcity = value, non scarcity = less value

I promise you that money printing will be going on until it stops. If it stops, goodbye real estate prices, goodbye corporate welfare, goodbye immigration/immigrants, goodbye jew agenda, goodbye wars.

Either the world fundamentals change over night (won't happen) or cryptos will increase in value per unit against the fiats.

Imagine if the gibs dry up..

Source: sun tzu

>War costs a lot of silver

>>

>>131948352

>Families

You mean the rich people getting richer.

>>

File: 1498049260274.jpg (462KB, 1019x1024px)

462KB, 1019x1024px

Oooh yeah, nothing suss going on in pic related.. USD or death.

>>

>>131966181

oy vey he's onto us

shut it down

>>

>>131966548

Bingo. The value of fiat currency is baked by force. USD and other sovreign currencies have value because their governments have an army and police that can force people to use that currency, otherwise people wouldnt work as slaves all of their life in exchange for pieces of paper printed by some random entity.

>>

>>131966087

>It'll inevitably climb in value cos the literal number of USD is circulation is climbing by the second

Bitcoins too right? Or have they all been mined? But yes once they're all mined you're right.

Now if we take the period June 15 - May 17

monetary inflation (BTC is still exposed to price inflation) is:

>M1

(3506/3017-1)= 16.2%

>M2

(13496/11977-1)= 12.7%

cf. https://www.federalreserve.gov/releases/h6/current/ for data on M1 and M2

Meanwhile BTC went up by (about):

(2530/230-1)= 1000%

Cf. http://www.coindesk.com/price/

So monetary inflation (assuming all bitcoins were already mined and BTC had thus no monetary inflation) is only about 1-2% of the price increase.

As for the remaining part, it can be due (under the classical theory) to fundamental reasons (more acceptance, more awareness of BTC etc.) and to bias (overconfidence). George Soros has shown (Alchemy of Finance) that bias and fundamentals are interrelated, especially for currency (and even more for cryptos) - speculative demand for crypto fuels new speculative positions and also increases awareness of bitcoin which increases actual transactions. But if the currency goes really too high and the share of fundamental reasons in the momentum is really low, it will end up reversing.

>>

File: global-debt-crisis-country-bankruptcy-risk[1].gif (29KB, 792x519px)

![global-debt-crisis-country-bankruptcy-risk[1] global-debt-crisis-country-bankruptcy-risk[1].gif](https://4archive.org/image/image-404m.png)

29KB, 792x519px

>>131948352

Damned retard faggot OP

>>

>>131967483

wow, you have a model that can accurately predict the risk of default of every country?

Sweeeet

>>

File: 1382102.jpg (37KB, 529x487px) Image search:

[Google]

37KB, 529x487px

>>131956990

Stopped reading when he went on about the money multiplier.

In fiat-currency system there is no such thing. Even (((wikipedia))) has a description of this.

>>

>>131967145

Like I said before, Italian police are crooked cos they don't get paid much in real terms.

Armies are the same, Iraq and the other circuses have quite quickly over ridden foreign occupation through chimping out. If force could have made them compliant, it would have. There's the hard limit to force, and it's only getting less and less by the day.

The other 'force' is media trickery, that's also on the ropes, (((they))) know banning 4ch and jewtube will just create 15 spin off sites that are harder to control/monitor.

Eventually we'll go back to ICQ/msn messenger style p2p communication if they come down on 4ch/jt/all clear web sites.

Right now, we're being forced by deception. Not a strong type of force imo.

>>

>>131967705

true

>>

>>131967430

But the idea won't reverse, that's why eth and ltc are coming up now. This is a more traditional trading arrangement, using a basket of currencies instead of just one hedges oneself against any fuckery.

It's only petri dish level theoretical conversation to suggest a return to $0 for btc, if that happened a different crypto would have replaced it. Not a return to Fiat because we all felt bad about breaking the jew dollat

>>

>>131948352

>Government debt = Private sector savings.

omfg, please finish your college degree before saying retarded things like this, an introductory course in macroeconomics isn't enough.

>>

File: ztnsnanloorbzxnwu-ps9y1tg4ecmda_ja0-wfxn11e.jpg (117KB, 576x768px) Image search:

[Google]

117KB, 576x768px

>>131967483

The top countries on that list (up to japan) don't own their currency. Germany down the list is an exception there as it is the work horse of europe (and the last bastion of the ECB ever printing euros).

>>

>>131967985

I agree that cryptos will never disappear. They can't grow at these rates indefinitely though.

Even if we have complete faith in the technology, if central banks think the threat is too important they will just ban them and make it a criminal offence to possess cryptos. And the thing is, to my knowledge you can hide the transactions in crypto but not the purchase of crypto with fiat from your bank account.

If they ever do that (especially in a coordinated way in major countries) crypto would probably go back to their initial levels.

Last month in the US congress they talked about how bitcoins helped terrorists or some shit. The narrative is ready.

>>

>>131968139

So it's not true then?

>>

>>131968139

you are a retard. That is a factual truth, no school of economics denies that.

And I have finished college, I have a masters.

Maybe you should learn about this crap before your country crashes like idiots again.

>>

>>131962863

It's not the Canadian gov't it's from those involved in the social contract who the government represents.

>>

>>131968212

great point. Plus i wouldn't trust those estimates much.

But the only countries that have high risk of bankrupcies are those who contract debt in foreign currencies they don't control (eg. all the eurozone countries).

>>

File: fuck off.gif (354KB, 300x365px) Image search:

[Google]

354KB, 300x365px

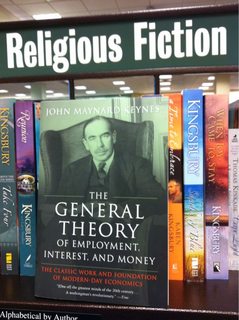

>>131948352

REMOVE KEYNESIAN

>>

>>131968609

keynes was always right and you know it.

Remove the jew banker.

>>

>>131968780

Except on probability...

>>

>>131964819

>Just make more money!

Jesus Christ.

>>

>>131968890

yes.

>>

File: 1470214123233.jpg (260KB, 400x600px) Image search:

[Google]

260KB, 400x600px

>>131968881

Elaborate

>>

>>131968780

On a more serious side though, yes, borrowing allows institutions-both private and public- to grow. But we've seen in places like Greece and Japan that eventually the money flow becomes harder and harder to maintain if the practices of the borrower demonstrate an inability to make repayments. The problem with socialism is that eventually you start running out of money.

>>

This dumb spaghetti nigger made the same thread in biz

Shill alert

>>

>>131969573

he advanced a theory of logical probability that he later accepted could not meet the criticisms of Frank Ramsey.

>>

File: 1417469707311.jpg (350KB, 598x800px) Image search:

[Google]

350KB, 598x800px

>>131948352

>>

>>131948352

gov debt burdens the tax payers and their children. fuck off. sage.

>>

>>131948352

This fag is clearly shilling for liberals.

>>131971947

>>

File: apu tuijottaa.png (193KB, 657x527px) Image search:

[Google]

193KB, 657x527px

>>131970953

Greece and Japan are a bit different:

As stated before, Greece doesn't have sovereign currency to ease it's debt burdens.

The 60% debt/gdp ratio demanded by EU is not based on any respectable, peer-reviewed studies. In other words, it's a debt crisis when the creditors say so. And slashing govt spending will just increase the debt burden more.

Profligacy, tax evasion and access to cheap credit made the mess sure, but if the creditors really want their money back they'd get it a lot faster without ruining the whole country.

And what's wrong with Japan? Nothing, it's just not growing (to some capitalists' standards). Over 200% debt to gdp doesn't mean jack shit. The problem is that the Japanese are hard wired to save and any amout of liquidity can't get them to spend, and more importantly, invest (mirroring growth-problems in the west).

>>

File: 1491044079424.png (126KB, 208x206px) Image search:

[Google]

126KB, 208x206px

>>131948352

Stop conflating gross and net variables.

>>

>>131972693

>it's a debt crisis when the creditors say so.

That's my point. There is no reason for creditors to call a crisis when there is no indication that their money wouldn't be returned. But there is reason, so crisis.

Japan is different because it is also dealing with a shrinking population that can barely pay for the current generation's spending. Let alone future debts.

>>

>>131967145

No, the value of a fiat currency is backed by the value of the goods people are willing to trade for using it. If it were only force, hyperinflationary episodes would never happen. The key driver is trust not force.

>>

>>131966548

When you see a quote that's too good to be true, check whether it's true, m8. That quote traces back to a shady guy who hates jews. Too fishy.

>>

>>131967145

So debt (fiat money) is good as long as we constantly start wars, topple governments, and generally shit all over people who try to be sovereign.

Fucking Wop

Thread posts: 142

Thread images: 20

Thread images: 20