Thread replies: 86

Thread images: 12

Thread images: 12

Anonymous

Keynesian Jewry or Economics? 2017-06-18 04:24:38 Post No. 130415273

[Report] Image search: [Google]

Keynesian Jewry or Economics? 2017-06-18 04:24:38 Post No. 130415273

[Report] Image search: [Google]

File: Screen Shot 2017-06-18 at 6.19.55 PM.png (33KB, 1240x116px) Image search:

[Google]

33KB, 1240x116px

> pic related

My (((university))) says lowering govt. spending lowers economic output. Makes sense because they're pumping fresh money into the economy.

Yet they say

> if you raise taxes and let the govt spend that shit you'll make back more than you took out

yeah right.jpeg

> no it's 132% true cause of this theoretical model called the multiplier effect we have

has it ever worked in practice?

> hehe we prefer not to say

/pol/, what is the economic jewry that's going on?

also - a bit unrelated, doesn't an increase in interest rates (while making loans more expensive) also make investments more profitable which is money put back into the economy?

Help me out here, /pol/, test in 2 days

>>

If the private sector is not spending the money (make it circulate) then govt spending has a positive effect.

Relating to the interest rate:

Raising interest rate makes the funding of possibly profitable ventures more expensive. When the central bank increases the interest rate it maybe want's to curtail profligate credit spending (over-heating economy) or decrease liquidity (makes reserves the banks get from CB more expensive)

T. Econ major

>>

>>130416056

Understood, but what about the positive effect of private lenders who are making money off high interest rates, who in turn put that money back into the economy?

Thanks a lot for the help, much appreciated

>>

File: 1494056695668.png (18KB, 463x425px) Image search:

[Google]

18KB, 463x425px

>>130416056

And then add qe

>>

File: 1478365638986.jpg (223KB, 900x1370px) Image search:

[Google]

223KB, 900x1370px

>>130415273

>>130416056

Modern day economics is like astronomy in 5000 BC

We see some things - supply and demand; phases of the moon. Very easy to predict and understand. But other parts of economics are like constellations in the sky - they are not just given mere names and labels, but superstitious power which the early-man astronomers sacrifice their chickens to. Now sacrificing your chickens to a constellation doesn't actually do anything, but it's a good show for the rest of the tribe - and your predictions about the moon are correct, so why can't your predictions about constellations and spirits be correct too?

This is the current state of economics.

All those trained in it are just like those trained by the early-man astronomers of the past, and what was ostensibly astronomy slowly transformed into astrology. The lies or guesses were believed as fact, retaught as fact, then other facts were built on those facts and before you know it, Jupiter - that bright star in the sky, is the father of all the Gods and a white lamb must be sacrificed on the Ides to curry his favor.

>>

>>130415273

While I disagree with the validity of models, the concept is correct but it also depends on the conditions that exist. If taxes are very low and there's a very high marginal propensity to save then you raise taxes, there is a benefit because you're converting would-be savings into spending in the real economy. However, if there is little marginal propensity to save and you raise taxes, it's negative because you're cutting into private spending in the real economy.

Also, the multiplier effect is very real and should be obsessed over almost to the point of autism. When you spend money at a store, you're not just supporting that individual store and its worker, you're supporting numerous entire supply chains spanning tens of thousands, if not hundreds of thousands of workers.

I'm a bit skeptical that your school would teach any of it, though. Most schools have abandoned rational thought in favor of equilibrium theory.

>>

>>130417885

Tell me your thoughts on the equilibrium theory, yeah, my course is obsessive over that.

>>

>>130417885

How is spending better than saving since savings are invested into the economy? Why should the government know what are the right time preferences better than economic actors?

>>

>>130415273

What do you expect from pseudo science that has no correlation with the real world.

Modern economics is basically all about spreading the ideas of free-market fundamentalism. Everyone questioning it is labeled as mad or conspiracy theorist

>>

>>130418198

Equilibrium theory is hogwash retardation. Just look at the assumptions baked into their models and you'll see how off the fucking wall it is. Not to mention how tragic it is that it became mainstream in the 70s until its peak in 2009 and lost a massive amount of its influence (although a ton of schools still teach it).

>>

>>130418504

Take your You, can someone answer this?

>>

>>130418504

>How is spending better than saving since savings are invested into the economy?

The simplest way I can put it is that your job is 100% dependent on spending in the real economy, not on capital being put to speculative use in the stock market and the like. Your income is dependent on other people spending their income and vice versa. If you have an excessive amount of people not spending their income and spending it instead, it will reflexively bend back and shoot themselves in the foot.

Also, when we're talking about "savings," it's not to specifically reference any investment actions, just that it is income which is not spent. However, typically these days it just gets dumped off into the stock market or put to some other speculative, non-productive use. Additionally, savings leading to investment aren't quite as needed as they may have been at one point because our modern financial system has evolved to de-necessitate the savings process in many ways.

>what are the right time preferences

I'm not sure what this means.

>>

>>130419486

I forgot to add:

There's a colloquialism that you'll hear sometimes (like on CNBC or some economists will reference it in their works) about the 'real economy,' which expresses the bifurcation between the economy people interact with every day when buying goods and services and where they derive their income from, and the 'economy' of the investment world which includes stocks, bonds, and so on. When money enters the investment economy, it's basically out of circulation and it's not inaccurate to think of the investment economy as generally wealthy people and fund managers shoving money back and forth at each other. It's not particularly productive unlike investment in the real economy by upgrading equipment and infrastructure. That isn't to say that the stock market and other paper asset markets are useless or anything, just far less useful and productive than the people involved would ever lead you to believe.

>>

>>130420263

Fantastic! This was the missing part of the puzzle for me. Cheers buddy, I might ace this test yet.

>>

>>130418510

Keynesian Economics:

>More Government Spending is good!

>Free-market fundamentalism

Pick one and only one, Finn.

>>

>>130417880

Saturn is Jupiter's father you dumb fucking leaf

>>

>>130419486

There is no demand without supply and no supply without demand.

All of the income that you spend is what drives demand.

Except if you bury the cash in the sand, all of the income that you don't spend and keep on a bank account is either used (by entirely by you or by the bank within the limits of capital requirements - fractional reserve system) to:

- Finance new projects (if invested into new issues / primary investments)

- Speculate on existing securities (secondary investments)

The former drives supply (no supply could exist without access to funding) and the second is a condition to the existence of the financial markets because it provides liquidity and price information.

And there is kind of an equilibrium relationship because if there is a higher demand for investment, the return on financial securities decreases and it becomes relatively less advantageous versus spending.

By time preferences I meant that the aggregate share of spending and saving is determined by the aggregate time preferences (if lower time preference, more spending and vice versa).

(1/2)

>>

>>130420830

(2/2)

Anyway, what I'm asking and would convince me of your theory, to be clear:

- Is there empirical evidence that there is an "ideal" ratio of spending and saving/investing, i.e. ideal time preferences, either in absolute terms or as a function of other variables?

- Is there empirical evidence that the State is more efficient than the markets in determining and reaching this ideal ratio?

>>

File: IMG_1337.png (253KB, 2880x2160px) Image search:

[Google]

253KB, 2880x2160px

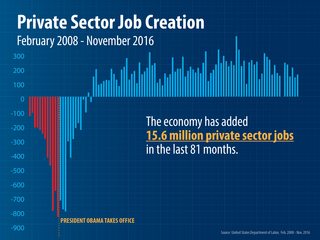

>>130415273

This is all you need to know

>>

>>130420830

>the aggregate share of spending and saving is determined by the aggregate time preferences

Just to be crystal clear here, I mean that if people speculate that's because they find it more attractive to spend that money later on for the rate of return that can get. All money will eventually be spent, either today if spending or later on if saving.

>>

Government spending employs a lot of people. The cut in spending in most cases will result in a decrease of jobs which means a decrease in consumer spending and so on

>>

>>130421280

Low quality jobs with less hours worked and in shitty sectors like retail or restaurants.

Also recoveries always follow crises, doesn't have anything to do with Obama's skills.

>>

>>130421019

>- Is there empirical evidence that there is an "ideal" ratio of spending and saving/investing, i.e. ideal time preferences, either in absolute terms or as a function of other variables?

According to my course, the very best case scenario is the propensity to save is zero in order to accelerate velocity of money and demand which will, with the multiplier effect, double, triple, quadruple, endlessly since no one is saving a cent anymore.

>>

>>130421899

But then how can you fund any project? Even at the very small level, if I want to open a small bakery I need a loan.

>>

>>130422071

it depends if the definition of "spending" includes real economy investments like helping you start a bakery. Each penny I get goes to buy ownership in your company for example.

Answering like my uni would

>>

>>130415273

I don't understand what you are saying, but I do now that Canada is a piece of shit. I didn't have to pay 10s of thousands of shekles to know that

>>

>>130415273

That's old Keynesian theory. It's not cutting edge economic theory, hopefully you will learn of the Solow model or the Neoclassical model later.

>also - a bit unrelated, doesn't an increase in interest rates (while making loans more expensive) also make investments more profitable which is money put back into the economy?

No. Investments aren't loans. An investment is more like real estate. You use the loan to fund your investment.

When interest rates rise, your gains on your investment fall, so investment falls.

>no it's 132% true cause of this theoretical model called the multiplier effect we have

The multiplier effect has to do with government spending increasing without raising taxes (i.e. running a deficit). You would see this if you looked at the Neoclassical model. If the government maintained a balanced budget all the time, then government spending would do nothing, it might even hurt since taxes aren't actually lump sum and distort the economy.

Even the deficit could be argued against with game theory approaches and time consistent economic theory. There is still some empirical basis for the multiplier effect though.

>>

>>130420830

This part will clear up some of it >>130420263

Other than that, you seem to be arguing equilibrium theory although it's framed very weirdly. Unfortunately, there is no equilibrium to be had; economics is a reflexive, self-propagating phenomenon and the critical component to it is perception. For example:

>And there is kind of an equilibrium relationship because if there is a higher demand for investment, the return on financial securities decreases and it becomes relatively less advantageous versus spending.

For one, if you're looking for a yield, spending will never appear more advantageous, especially after you've already spent what you wanted and everything you made afterword is just savings. Second is that increasing asset prices can reflexively alter perception/sentiment and encourage more spending (or demand if you want to put it that way) on that asset. Hence why trends exist and can be seen in virtually any market -- they're sentiment driven.

>>130421019

>Is there empirical evidence that there is an "ideal" ratio of spending and saving/investing

Well, the issue here is that I disagree with the phrasing. There is no magic/perfect number that you can sit on for all time, just like there is not magic/perfect equilibrium point for prices. What there can be is a rate that yields 'better' results given the current circumstances and something to be altered when circumstances change. But again, personal savings leading to investment isn't needed like it may have been once upon a time. For example, our banking system could continue on even if no one is putting money in their accounts; lenders can and do lend using deposits from the federal reserve all the time.

>>

>>130422378

Primary investments would be much less attractive without the secondary market. Small loans are a bad example because they're illiquid. But if you take liquid securities like bonds or equity, if you can't sell them when you want it's much more risky and not flexible enough to adapt to your utility function (e.g. 30-year bond for a 100-year old investor). Also the price information provided by secondary markets helps you determine your asset allocation. Knowing what is the right price for buying ownership in a bakery is much more difficult without information on bakery stock share price performance.

>>

File: Screen Shot 2017-06-18 at 7.53.27 PM.png (113KB, 894x668px) Image search:

[Google]

113KB, 894x668px

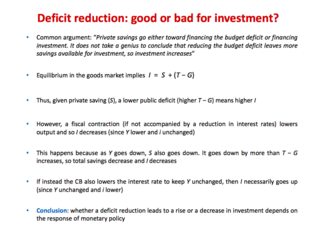

Thanks for all the responses, I've learned a lot.

Here's a slide from my course which addresses this very discussion.

>>

File: austrian_vs_keynesian.jpg (2MB, 1300x4080px) Image search:

[Google]

2MB, 1300x4080px

>>130415273

Keynesian Jewry. Swallow the Austrianpill

>>

>>130415273

They have it reversed. A more productive economy generates a lot of wealth, which the government can steal and waste. Printing money is not the same thing as creating wealth. If government spending increased economic output, there would be no such thing as poverty. Government could just tax everyone at 100%, and prosperity would follow. Your university is an idiot.

>>

>>130421803

>Low quality jobs with less hours worked and in shitty sectors like retail or restaurants.

And within 5 years all those jobs are going to be gone as amazon starts delivering groceries to your door.

>>

>>130416056

If the rich are not spending money, it is in the bank. The bank lends out the money to people to buy homes, cars, iphones, etc. The government creates nothing. It just steals property from its rightful owners, and gives it to parasites. You need to learn a bit more economics, instead of just regurgitating statist stupidity. You need to learn to think, NOT memorize and repeat obvious nonsense.

>>

>>130423767

>jewconomics vs jewconomics

either way you're getting jewed

>>

>>130421483

But, the resulting cuts in taxes will give the taxpayers more to spend, which will offset the loss in spending power by the parasites.

>>

File: neon hoppe.jpg (1MB, 1007x946px) Image search:

[Google]

1MB, 1007x946px

>>130424106

This. Taking economics in university is the most bluepilled thing you can do since they usually teach Keynesian Jewry. The (((Federal Reserve))) and other (((central banks))) are establishments that are endorsed by the Keynesian school after all. Really makes me think

>>

>>130424476

>"I know nothing about economics" the post

Yeah dude, the economy just works. Retard

>>

>>130424382

>If the rich are not spending money, it is in the bank.

If the rich are not spending money, it's in assets and investments. The rich know banks are a scam. They use banks, but they don't keep all their money in bank accounts - not past what they might need liquid.

If you want your wealth to be secured, you need to invest it into a large variety of assets. Everything from alternative currencies to stocks and bonds, to property and land, to businesses.

>>

>>130424773

not an argument, mises

>>

>increasing asset prices can reflexively alter perception/sentiment and encourage more spending

If (all other things being equal) increasing asset prices decreases the relative attractivity of investing and increases the relative attractivity of spending, it means that markets are working.

"Animal spirits" is more when people invest more when asset prices increase because they think they will increase forever, like in the real estate bubble.

I kind of agree that perceptions can be distorted for some time but in the long run I don't think so. All bubbles burst eventually. A countercyclical mechanism might at least reduce instability but I'm not sure whether governments are any less biased than investors - look at sustained deficit spending and skyrocketing government debt.

>There is no magic/perfect number that you can sit on for all time

I said "as an absolute number or as a function of other variables". I'm asking whether at any time t, there is an ideal propension to consume or to save which will create real economic value rather than just transferring wealth over time (forego some output this year for more next year or in 10 years) in a way that maximise aggregate utility.

I'm also asking whether there is any evidence that if it exists, lawmakers are able to identify and reach it.

>>

>>130425169

Go kill yourself you fucking leaf

>>

>>130423525

I very much disagree with the way they're going about teaching it and some of the fallacious reasoning behind that slide. That's one of the many big problems with equilibrium theory: they make too many absolutist assumptions and try to force things into a box to fit their theory.

>>

>>130423235

>For one, if you're looking for a yield, spending will never appear more advantageous, especially after you've already spent what you wanted and everything you made afterword is just savings

True; it's rather the other way around, yields reflect time preferences - whether people prefer to spend more money now on food or drinks or reduce their consumption today to go in holiday next year or so.

>>

>studying econ, year 1

>professor wrote her own macro book because she wanted to jew her way into the percentage from books sold

>it's fucking horrible

>understand maybe 30% of this thread if I strain myself

I need to get myself a proper foreign macro book holy shit

>>130424664

here they just explain what keynesianism is and its principles but every teacher says it's outdated and a thing of the past

>>

>>130425492

Feel free to actually get an argument at any time

>>

>>130425492

I agree with the Leaf (for once).

Present an argument or fuck off.

Also show your geographic flag.

>>

File: 1480800572980.png (849KB, 1200x860px) Image search:

[Google]

849KB, 1200x860px

>>130423767

>keynesian econ is mainstream

why do we have to suffer

>>

>>130425091

Only fractional reserve banks are a scam; full reserve banks are not.

Except if 100% backed with gold or silver, cryptocurrencies are an even huger scam than banks. A bitcoin has almost no underlying value.

>>

>>130427197

what's the difference between bitcoin and let's say SDRs then? does the fact that SDRs can only be used for correcting the balance of payments come into play?

>>

>>130425323

>If (all other things being equal) increasing asset prices decreases the relative attractivity of investing and increases the relative attractivity of spending

This does not occur and to claim so is to basically claim that trends do not exist. A perfect example is the many $trillions worth of negative yielding bonds in mainly European countries: There's no reason to buy them unless your perception is that the bond value will continue to increase faster than the loss from the negative yield. There is no equilibrium to be had and surely if there were, it'd kick in at the time where you have negative yield on a yield-centric asset. If a particular asset price or asset class increases substantially, it can affect perception to look toward other investments and gauge their relative attractiveness, but it will never be converted into spending.

>I kind of agree that perceptions can be distorted for some time but in the long run I don't think so.

Here's the thing though, perception, or rather the prevailing bias is what drives all market action and pricing. One of the big reasons why no equilibrium can exist is because the actors within the market are conscious and inherently biased and will only make decisions that seem rational from their own point of view which is affected by imperfect knowledge and imperfect understanding -- things which equilibrium theory entirely ignores.

>I'm not sure whether governments are any less biased than investors

That's true, but If you're the government and look at the situation of wealthy people (for example) spending on average just 25% of what they earn (again, for example), you can rationalize that raising taxes on them a bit may not be a bad idea. It's much easier to get a clear picture of that and act accordingly than most other things.

> I'm asking whether at any time t, there is an ideal propension to consume or to save which will create real economic value

That depends on your perspective.

>>

>>130425733

I think you might underestimate how much people reinvest for the sake of it and with no conceivable end goal in mind. Wealthy people stay wealthy and grow wealth by constantly reinvesting what that make from their investments.

>>

>>130427892

Then just require wealthy people to spend more of their money. No reason to steal it. Also, for the millionth time, if they SAVE 75% of their money, the bank lends it out for people to buy cars, houses, tvs, etc. Only stupid thieves believe that "it's beneficial to steal idle money" meme.

>>

>>130427559

1) SDRs are pegged to a basket of currencies (weights reflect their importance in the world economy), bitcoin is not. You would need to assume that internet savvy, e-currencies regulations and relative interest for e-currencies are the same in all countries for them to be equivalent.

2) Anybody can buy bitcoins, not anybody can buy SDRs as far as I know it's only governments.

3) Significant legal & political risk: Most importantly, SDRs were created by the IMFs and are used and approved by the government. Bitcoin was created in some dark areas of the web and governments are deeply distrustful of it. The day major governments ban it because (officially) of money laundering and terrorism financing, the only value of the bitcoin will be for illegal transactions and it will only be used by ISIS and mafias. It will go back to trading for pennies on the dollar like at the beginning.

4) Bitcoin also has significant technological risks (like hackers launching attacks on bitcoin exchanges).

5) Competitive Risk: Bitcoin has a lot of competitors like Ethereum, Monero etc. Even without ban and regulation, it might just happen that Ethereum becomes more attractive and everyone switches to it. Then bitcoin exchange rates will drop.

>>

>>130416056

How about not putting price control on credit, which is effectively what is done?

>If the private sector is not spending the money (make it circulate) then govt spending has a positive effect.

There is no single reason why spending money as such is good. Even less so for using force to do so. There are many, many reasons why not spending money outright can be better than spending it. Of course if you "measure" prosperity in terms of money spent, a year with less money spent is a depression.

>>

>>130428760

Point 5 is often neglected. The truth is, bitcoin is inferior from a technical standpoint to more recent crypto. All it has is that it came earlier and so has gathered more buzz and memetic power, at least for the short term.

My normie friends are already afraid of bitcoin when it entered pop culture at least two-three years ago. Of course the value of money is determined by what normies will accept as exchange.

>>

>>130428558

>Then just require wealthy people to spend more of their money

That's awfully draconian.

>, if they SAVE 75% of their money, the bank lends it out for people to buy cars, houses, tvs, etc.

This has already been covered earlier. For one, a marginal propensity to save doesn't reference any particular action with the savings, just that it is a portion of income which isn't spent. Secondly, our financial system has advanced such that banks don't technically need deposits from individuals to function, they can and do lend via deposits from the federal reserve all the time.

If you want to go on about the 'taxes are theft' thing, then you're too far gone for me to bother with.

>>

>>130428558

Wealthy people, especially the old-wealth, don't spend their money on frivolities like poor people do. When they spend big bucks, it's to make big bucks in return.

This creates a problem where the rich just keep accruing more and more wealth over generations.

The solution isn't in taking the money from them, it's creating a system that doesn't reward this behaviour. Unfortunately alongside the large amount of wealth comes a large amount of power and influence, so the system that benefits these people is perpetuated even if it destroys everything and everyone else.

The rich won't care until it completely collapses around them - and then they will blame everyone and everything except themselves.

>>

>>130427892

For negative yielding bonds, it's partly because the real rate of return (corrected for inflation and exchange rate movements) might be positive. But I do agree that it's also for psychological reasons; risk aversion went all up after the global financial crises, so the demand for government bonds has surged to crazy levels. It's currently going back to normal though.

Prices are partly driven by perception bias and, although all bubbles burst eventually, it creates instability. But the benefits of having free financial markets far outweigh these drawbacks.

Intelligent regulation and economic intervention is very possible in theory but again I'm having a hard time to believe that governments (especially in democracies) wouldn't have even stronger bias than investors.

>>

>>130429537

Well in your scenario the rich did literally nothing wrong, so they are not going to blame themselves.

It's really a consequence of time. If you are 5% more productive with your money than someone else per year, that makes you gorillonz richer over a lifetime, and you can spend any part of it (from all of it to very little) at any time.

>>

>>130429321

Oh, yeah, not as draconian as just STEALING it. Are you really fucking retarded? We already went over this. If you steal $50,000 from a rich guy, he can't buy that new car. Instead, someone ELSE, who Didn't earn the money, gets the car. No additional cars are created. Money is an illusion. People of low intelligence and even lower moral character are seduced by the "idle money is OK to steal" meme. Mathematically, it can't be true. Ever hear of something called a balance sheet? We already went over this. Throwing out a bunch of bullshit terms they taught you in government school to justify theft does not make it right. INVESTED money builds factories, inventories, cars, etc. No getting around it. Stealing from the wealthy and giving it to the stupid and lazy results only in the creation of more stupid and lazy people, while simultaneously reducing the number of payers. The multiplier effect is also a falsehood. If a person who earned money spent it, the multiplier effect is the same as if someone else stole it, then spent it. Work it out with a t account, if you know how.

>>

>>130431349

The rich ignored their responsibility to their community. They have power and influence and use it only for selfish aims; the system itself shouldn't cater to nor reward this kind of behaviour because it begets social instability and leads to war and revolution.

That's the problem with "wealth is the only thing that matters" - It's a 'fuck you, I got mine' mindset and is a direct cause for most of our social ills.

>"We do not say to the rich: 'Give to the poor!', we say: 'German people, help each other!'. Rich or poor, each one must help thinking, 'there's someone even poorer than I am, and I want to help them as a fellow countryman.'"

>>

>>130429537

Actually, if EVERYONE engaged in wealth accruing behavior...EVERYONE would amass wealth, and pass it down to their children. Building wealth MUST be encouraged. The reason that the rich keep getting richer is that they do the things which create wealth. The poor keep getting poorer because they keep doing the things which make people poor. The things which people do to make themselves poor must be discouraged, NOT the actions which create wealth. Unbelievable that someone would advocate DISCOURAGING wealth creation, and ENCOURAGING poverty creation.

>>

>>130416385

QE is the equivalent of raising the money supply through lower interest rates, except it's used when the economy is in a liquidity trap and the interest rates are near zero.

Rather than incentivizing people to sell bonds by cutting the interest rates, they simply buy the assets directly from banks

>>

>>130421280

Yet this rate of job growh in percentage terms is one of the slowest recoveries ever.

>>

>>130431169

>For negative yielding bonds, it's partly because the real rate of return (corrected for inflation and exchange rate movements) might be positive

The only way those bonds will have a positive return is if people continue buy it and the only way people will buy it is if they *perceive* it will rise in price faster than the negative yield will drain money from you. Obviously, there's no future-seeing crystal ball so it's entirely perspective driven. But, this is true for all things within markets. Prices are only reflective of sentiment, not of some equilibrium between supply and demand.

>Prices are partly driven by perception bias and, although all bubbles burst eventually, it creates instability.

They're entirely driven by perception and bubbles aren't the only reflection of that. When you buy a stock or an index fund for example, you do it because, for whatever reason, you perceive that the prices of these will increase. You have no real way of knowing that they will, but certain things have influenced your perception that it will increase and you take action off of that perception. Similarly, when you go to the store and buy anything, you do so from an entirely biased perspective and the only difference to paper markets is that there isn't an immediate market feedback from your purchase.

> But the benefits of having free financial markets far outweigh these drawbacks

I'm not arguing against having relatively free markets and free enterprise, I'm arguing against equilibrium theory and the policy prescriptions based off of it.

I think you may benefit from this, and yes, I disagree with his politics but he's very correct in his analysis:

https://www.youtube.com/watch?v=TI0V04dP4t8

It's really served me as sort of the 'missing puzzle piece' of economic understanding.

>>

>>130423525

I've seen it taught as this:

I = b0 + b1Y - b2i

Basically Investment has a sensitivity to sales, represented by output, which is b1 and a sensitivity to interest rates, b2.

Since deficit reduction cuts Y, because of lower G yet also causes a higher i,

Depending on which of the two sensitivities is larger, the effect on output is either positive or negative.

>>

>>130432855

How vapid. We're done.

>>

>>130432855

What they mean with the multiplier is Money Supply = Monetary Base * Money Multiplier - the more the monetary base is used in transactions (rather than standing still in a bank account), the bigger the money supply.

The thing is that normally prices adjust for that (cf. Fisher Equation). There is disagreement over how quickly and proportionately they change but nobody disputes the basic mechanism. So at best the multiplier can only create short term value.

>>

>>130433208

There isn't infinite wealth - there aren't infinite resources.

Our current economic system has winners and losers. You cannot have everyone be a winner.

>Unbelievable that someone would advocate DISCOURAGING wealth creation, and ENCOURAGING poverty creation.

Unbelievable that someone refuses to understand the very system itself prevents the elimination of poverty. There is no wealth creation or poverty creation, there is only wealth accumulation/redistribution. And that wealth slowly accumulates in the hands of an ever shrinking fraction of the population until the wealth is completely useless for the majority and an economic reset occurs. A man with all the money in the economy is a poor man.

We can redistribute wealth to the rich, we can redistribute wealth to the poor; in either case it is no good.

Wealth should not accumulate at all - remove all the lubrication from the machine and it seizes up and dies. Wealth needs to constantly flow, not accumulate.

>>

>>130434052

>The only way those bonds will have a positive return

No.

If a bond has a yield of -1% but yearly inflation is 5%, cash value decreases by (1/1.05)-1 = 4.7%. The real rate of return is nominal rate - impact of inflation = -1%-4.7% = 3.7%.

If a EUR bond has a -1% yield and the exchange rate is 1 EUR/USD at time t, but over a year the exchange rate goes to 1.5 EUR/USD, for an American investor the rate of return is positive.

>They're entirely driven by perception

Yes but perception = knowledge of real information + bias, not only bias.

>>

>>130435162

>cash value decreases by (1/1.05)-1 = 4.7%. The real rate of return is nominal rate - impact of inflation = -1%-4.7% = 3.7%.

Forgot a negative sign for 4.7% in both computations but you get my point.

>>

>>130415273

>Economy jewry

I call it GDP-fanaticism. What capitalists and marxists hate the most, commonly, is "static money", the money that rests outside the flow, does nothing to drive the eceonomy. Therefore the inflation.

Taxation can help solve these (((problems))). Retarded economy-boosting solutions such as helicopter money have been proposed by the jews in order to (((boost economies))) precisely for this reason.

The problem is, capitalist societies tend to rely on markets to adapt to popular demand. These new (((modern economic solutions))) are doing the opposite of that, they are adapting popular demands in favour of their internal markets.

>>

>>130434052

>I think you may benefit from this, and yes, I disagree with his politics but he's very correct in his analysis:

>https://www.youtube.com/watch?v=TI0V04dP4t8 [Embed]

>It's really served me as sort of the 'missing puzzle piece' of economic understanding.

Book looks interesting, will read.

>>

>>130433128

Nothing in my post was implying that.

Besides, having lived both in both very rich and very poor environment, poor people are more obsessed by money. You may say it's understandable, but it doesn't excuse anything.

The argument was about the claims of spending much or not. Also money is not what the community is about.

>There isn't infinite wealth - there aren't infinite resources.

Wealth is not merely made of physical objects, and the way physical objects are used is what makes most of the wealth. Unless tou are assuming that the technological and operational know how will never change, amassing resources is not the primary factor here. It only ignores the fact that we are nowhere even close to using all the Earth's resources, let alone if we start mining off planet.

Your post is "muh share of the pie" tier.

>>

>>130424382

If you studied economics you'd know that banks don't lend out peoples' deposits. It breaks accounting rules.

>>

>>130415273

>Makes sense because they're pumping fresh money into the economy.

taxed money is anything but fresh money.

the only "fresh" money being pumped into any system is more worthless fiat debt money being printed by the central bank, at interest, and at risk of inflating and further devaluing the already inherently valueless currency even more.

>>

>>130428760

>>130429313

If a state was say to accept tax payments in whatever cryptocurrency, say btcoin (parallel currency), and then force employers to pay normies in btc if they requested it, currency would surge and it would be extremely difficult for any other crypto to just replace it and inflate it.

> The truth is, bitcoin is inferior from a technical standpoint to more recent crypto

What is this "progresssive" technology other cryptos have, but bitcoin doesn't? I don't think it's anything that normies really care about, as far as I've heard it was mostly some fancy technologies for investors and shit.

>>

File: 1461869182530.png (735KB, 1278x780px) Image search:

[Google]

735KB, 1278x780px

>>130435877

>These new (((modern economic solutions))) are doing the opposite of that, they are adapting popular demands in favour of their internal markets.

Come on, you don't say that we need to provide the goyim with things they would actually want to spend shekels on without monetary intervention. Better to just create (((conditions))) where we use trickery to force them to spend. You don't want a stagnant economy, don't you? Everyone knows that money spent = wealth! It's obvious, don't question it. Think of the spending-based GPD number that will fall if you don't spend your money right now.

Reminder that (((economists))) unironically think that cleaning your place yourself is detrimental to the economy compared to hiring a maid, even when the end result is worse with the maid.

>>

>>130435162

Your math is way off on that.

More descriptively of what happens with a negative yielding bond and inflation is that you invest money into it (say, $1,000) and over the period of a year, you have to *pay* a certain amount of money to the issuer for holding it (say, -1%). The only interaction here is money being taken from you.

So you put $1,000 in initially and then you have to pay the borrower 1%, or $10, meaning that your net equity is now $990. To figure out the real rate of return you have to factor inflation (5%) which gets subtracted from the position's net equity. In this scenario, the real value of the principal in the bond would deteriorate by 5% down to $940.5 for a net real loss of -5.95%.

>If a EUR bond has a -1% yield and the exchange rate is 1 EUR/USD at time t, but over a year the exchange rate goes to 1.5 EUR/USD,

That's just a reflection of currency speculation, not actually making money off the bond.

>Yes but perception = knowledge of real information + bias, not only bias.

Ah, but it's really a scenario where facts and information are filtered through a bias to form a perception.

>>

>>130421280

see

>>130421803

and pic related

>>

>>130437180

Yep, this is exactly the kind of mindset these psychopaths have - and I'm critical of it. Glad I'm not alone.

>>

>>130437380

I meant that to be this image.

>>

the "multiplier effect" literally cannot be measured

bscly the whole economic theory relies on there being a positive feedback loop

>>

File: 6b15becd4748ffd9d1b34494aaa2879a.jpg (19KB, 480x360px) Image search:

[Google]

19KB, 480x360px

>>130415273

Economist are the modern equivalent of alchomists, they basically say something will happen and if it happens they are see as magic wizards who can predict the future.

Basically they have no fucking idea what they are doing ever.

t. econ degree

>>

>>130437649

Even Monetarists and some Austrians believe the Multiplier is calculable. The problem is the incalculability of the malinvestments caused by the underlying monetary policy.

Thread posts: 86

Thread images: 12

Thread images: 12