Thread replies: 95

Thread images: 23

Thread images: 23

File: Capture.jpg (101KB, 1035x454px) Image search:

[Google]

101KB, 1035x454px

I lost $45,000 from the GBP "flash crash" yesterday. AMA.

>>

>>1550263

Was that money you could afford to lose?

>>

>>1550266

Yea, but it still fucking hurts really badly.

>>

File: 1468717179362.jpg (41KB, 780x438px) Image search:

[Google]

41KB, 780x438px

>>1550263

>>

What happened here?

>>

File: GBPUSD-October-7-2016-flash-crash.png (50KB, 990x567px) Image search:

[Google]

50KB, 990x567px

>>1550283

The british pound plunged suddenly yesterday, it triggered a margin call in my account and all my positions in GBP/USD and GBP/EUR were liquidated at a massive loss.

Noone even knows why it happenws but theories range from a "fat finger" (an institutional trader accidentally entering a big bigger trade than they meant to), computer trading algorithms, or comments from the French president about "brexit".

>>

>>1550263

what made you invest

>>

>>1550303

>margin call

Ah. Thanks. Couldn't see you had money hinged on the GBP in two other currs.

Do you trade forex on margin for personal or institutional reasons?

>>

>>1550311

I had long positions in GBPUSD and short in EUR/GBP, was hoping for a long-term turnaround for the GBP because it has been so oversold recently. Even before this happened, i had been losing thousands of dollars every day for the past week. This was just the final nail in the coffin.

I'm currently debating whether I should stop trading forever, or scrape together all my remaining resources (around $50k) and re-enter the market with a suicide exit plan if I lose it all.

>>

>>1550330

good luck op

>>

File: 1289687626055.jpg (44KB, 656x656px) Image search:

[Google]

44KB, 656x656px

>>1550330

Go back in.

You'll make it. I believe in you.

>>

File: 1473462011088.gif (2MB, 232x232px) Image search:

[Google]

2MB, 232x232px

>>1550330

you clearly have no idea what you are doing if that kind of "flash crash" blows half of your bank account. you are way too much leveraged first of all, but even then it does not seem like you have too much experience

>>

>>1550339

op just lost the battle but not the war

>>

>>1550330

why do you trade?

>>

File: wJfhHyc.jpg (57KB, 396x594px) Image search:

[Google]

57KB, 396x594px

>>1550346

yes

>>

>>1550339

>too much leveraged

Yep. I had about 90% of my trading capital risked on those trades, which looks incredibly stupid in hindsight, even though I felt really confident about it. The problem is that in the past, I have made huge profits from these stupid high risk gamble trades.

If I ever trade again I would take this as a lesson to never risk so much regardless of how sure I think I am. Even if that flash crash didn't happen, I would still be fucked because the situation looks so bad now for the British pound and doesn't look like it will improve for a long time.

>>

what broker? at least you don't owe them money.

>>

>>1550365

TDAmeritrade.

>>

File: WhenWasThisSupposedToPullUp..png (38KB, 966x557px) Image search:

[Google]

38KB, 966x557px

>>

>>1550263

learn to hedge people its not that hard

>>

>>1550372

I would stay far away from any GBP pair for the time being. It is too oversold to enter short at this point, and there is no meaningful support anywhere in sight. All it will take is more bad news for it to start dropping to even further extremes. Who knows if we see the Pound being equal to the Dollar and Euro soon.

>>

>>1550404

>forced to parity

That's the joke. The UK tried to stay out of the Euro, but it just might join it in another way.

>>

>>1550423

The Paki Pound sucks anyways. Would never risk it on that especially now... You sound like a gambler to be honest

>>

>>1550263

How long have you been trading? Did you dollar cost average into the position? Did you not have time to meet the margin call?

>>

File: Why_did_the_pound_fall_so_fast_-FT.png (719KB, 716x3385px) Image search:

[Google]

719KB, 716x3385px

I'm interested in this

>>

File: Pound_struggles_to_recover_after_plunging_6%_in_2_minutes-FT.png (751KB, 723x4443px) Image search:

[Google]

751KB, 723x4443px

>>

>>1550707

>Did you not have time to meet the margin call?

It happened literally within seconds, hence the term "flash crash", the price mostly recovered afterwards, but by then the damage was already done to my account as my positions were all liquidated.

>>

this is why we set stops

>>

>>1550861

I usually use stops but really big stops, as I am mostly a long term trader and have seen too many situations where the price hit my stop and then immediately went in the opposite direction

I have already went through the 5 stages of grief and ready to move on now. I am still going to short EUR/GBP at 0.90, with a stop at 0.91 and target price of 0.85. This time I will have a much smaller position size.

Also planning to go long on Gold.

>>

>>1550884

i am also long gold

and long bitcoin too :))))

>>

>>1550423

I have a feeling that's the plan all along. Make Brexit as catastrophic as possible, have the whole thing called off one way or another, then make part of the "punishment" be accepting the Euro, as the pound has dropped to being worth the same anyway.

>>

File: How_flash_crash_‘hell_broke_loose’.png (368KB, 707x2859px) Image search:

[Google]

368KB, 707x2859px

>>

File: Algos,_Barriers,_Rumors_Some_Theories_On_What_Caused_The_Pound_Flash_Crash.png (515KB, 943x1482px) Image search:

[Google]

515KB, 943x1482px

>>

>>1550263

Why do you willingly choose to play a zero sum game?

>>

If you had invested in cryptocoins you would lost 30% at most. (I already made a good profit out of cryptocurrencies)

>>

>>1550330

>hoping

You cannot invest based on hope, that is just gambling.

>oversold

Says who? You? Do you know what efficient market is?

>and re-enter the market with a suicide exit plan if I lose it all.

>suicide plan

This game is not for you.

>>

>>1550303

How do they get volume in Forex? Is it from Swaps?

>>

File: A_Look_Inside_The_Pound_Flash_Crash_What_Really_Happened_In_Those_30_Seconds.png (828KB, 970x3076px) Image search:

[Google]

828KB, 970x3076px

>>

>>1550905

Just buy potcoin with your 50k

>>

File: Exclusive_Insight_Sterling_Quotes_Differ_1000_Pips_across_Different_Brokers.png (1MB, 861x7072px) Image search:

[Google]

1MB, 861x7072px

>>

>>1550263

you should trade with a wide margin, at least have some safety net.. you live the dangerous life, my friend

>>

>>1550263

How many tendies is that worth?

>>

>>1550263

>tfw I knew this would happen but don't trade FX, fuck me.

>>

>>1551266

>tendies

I don't get the thing about "tendies" even though i've heard it mentioned on here a few times. Care to explain?

>>

>>1551289

The NEETS here get chicken tenders from their moms delivered to their rooms. To get their tendies they have to have enough "good boy points" on their good boy calendar

>>

>>1550263

You have 50 grand left. I'm curious as to how much you started with to build up to $100k?

>>

>>1551303

I sell private labelled health and beauty products, mostly on Amazon and through my websites. I typically do between $8-12k monthly in sales online.

The thing that really made me alot of money recently and the reason I have money to flush down the toilet with trading is getting a few big distributors overseas who are importing my products into their countries. They typically place orders of a few thousand units at a time, and typically every 2-3 months or so.

>>

>>1551307

Well, I know it sucks losing money, but at least you have an out.

I don't know how much you originally deposited into the forex to build up to $100,000, but it wasn't the whole $100,000 was it? I'm thinking it was probably $60,000 at the most.

>>

>>1551315

Oh, i misread your question. I deposited a total of $45,400.01 into that account. At my peak I grew it to around $80k but was too stupid and greedy to stop there. I don't count the profits I grew in the account as my total loss, just my actual money that I deposited and lost.

>>

>>

>>1551322

Yeah, it's actually a dumb question being I didn't enlarge your original pic. Worst case scenario you have a write-off (I'm aware you can't write it all off, but you can carry it forward). And money consistently coming in. I've backed myself into corners where I had no outs.

Hope you check in again in the future. Good luck, bud.

>>

>>1551323

How do you capture web pages like this?

I use a browser plugin called "Screengrab!" to capture the image. I use a plugin which limits cross site request to filter out ads, and I use the browser's F12 built in developer tools to trim out irrelevant pictures to cut down the size of the captured image.

>>

>>1550339

agree with this guy. looks like you accept and admit it here >>1550358. i've been trading over last 6 or so months purely forex for chump change. i'm batting 100% wins so far. my personal rule is to never put on more than 50% on a position and exit within 1 week. i'm at the point where i can enter and put in some limit orders for the overnight session and not sweat. i used to pull all nighters.

>>1550404

there was actually a retracement play on the GBP after the flash. 2 in fact, worth about 50 pips each. i was considering buying in long but decided to trade the US and canadian unemployment reports instead. made a small amount today. 8.5% on risk capital. the question is how much was my risk capital? small. being right is far more important. it's giving me the confidence to hold for longer. i've missed out on a lot of big trades due to nerves. only once due to a overleveraging. i couldn't execute my strategy after i calculated the worst case scenario for margin reqs. got out of that trade with a tiny profit. best lesson i've learned so it was worth it.

>>1550884

recommend you don't use stops. big algos and institutional traders love hunting for stops like that. nice even numbers. in fact, the flash crash may have been such an event. to squeeze people with miniscule liquidity remaining and take their accounts. will be very funny if the flash signaled the bottom of the GBP over the coming months.

good luck. allah be with you

>>

File: FX_Update_Pound_flash_crash_ahead_of_US_payrolls.png (154KB, 752x1143px) Image search:

[Google]

154KB, 752x1143px

>>

>>1551349

Thank you, this is great.

>>

>the bulk of the plunge took place in just 30 seconds: from 7:16 to 7:46, when the market became "disorderly" in technical parlance, or in simple terms, broke.

>we’re getting greater liquidity gaps

>One trader told Bloomberg that his FX pricing aggregator of eight contributors blacked out for 30 seconds amid an absence of bids.

“There were almost no offers, no bids when this happened,” said a trader at a European bank in Tokyo.

>The drop accelerated as liquidity disappeared, and dealers failed to load bids into their trading platforms, say traders. In other words, your plain, garden variety algo-facilitated flash crash, where the bid side suddenly disappears as one or more "liquidity providers" turn themselves off.

>drove the exchange rate to the point where there were essentially no bids for a brief time before a sharp recovery set in.

>“The move down from $1.26 to below $1.25 was orderly in the sense that bid-ask spreads were normal — but not once we got down through $1.24,” said one Sydney-based trader. “That was when all hell broke loose.”

>while GBP interbank volumes when Cable sold off to a low of 1.1491 traded, moving almost 10%. What were the key liquidity traits seen?

>primary market is usually 1 to 2 pips, however overnight, we saw this spike to over 50 pips up to over 600 pips.

>This means that individual trades were over 50 pips apart, e.g. 1.2500 given, then 1.2450 given as the next trade, with there being vacuums of liquidity in between.

>This was driven by the very large bid/offer spread in the interbank market at the time.

>primary market bid/offer spread which blew out to 10 big figures maximum

>could be associated with the high frequency market making interest leaving the primary market

>From some liquidity providers, there was a full system reset. Your spread got wide and nailed you - your whole trade, target, entry, stoploss, was inside of the spread. For a few moments there wasn't actually a market there.

>>

>>1551270

>>tfw I knew this would happen but don't trade FX, fuck me.

There is not a chance you would have gotten exact same fill price as your take profit in these conditions. It should have slipped a lot lower in price.

>>1550861

>this is why we set stops

>>1551468

here's some interesting quotes I've compiled from different places. If you where long your buy stop would fill would slip way below where you set it and it would make your losses much worse than what you thought possible, and if you where short your takeprofit order would have huge slippage too erasing a lot of your unrealized profit.

>>

File: even if the big boys caused the crash there is no liquidit to get filled to take profit.png (33KB, 1275x220px) Image search:

[Google]

33KB, 1275x220px

>>1551470

>institutional traders love hunting for stops like that. nice even numbers. in fact, the flash crash may have been such an event. to squeeze people with miniscule liquidity remaining and take their accounts. will be very funny if the flash signaled the bottom

At first when I saw this I thought exactly this, that this was just the institutions and market makers hunting for stops to accumulate at the bottom, and it was a perfect setup and perfect time for a stop hunt.

But pic related is an interesting comment I came across that raises an interesting question. How would the institutions expect to find enough liquidity at get their huuuge institutional sized orders get filled during the bottom of the crash?

>>

>>1551486

>>1551489

suppose you're so big, you can put on massive sell orders to negatively affect the bid. the traded instrument becomes so cheap, you can reverse your position, get even bigger on the way up. all that mattered, was affecting the bid/ask of the other market participants that saw these massive sell orders come up. it's like a poker bluff. you actually didn't need orders to be filled. it would have been sufficient to flag massive size at 1.26. and as the bids moved lower, sell order matched it all the way down.

GBP/USD crashed from 1.26 to 1.23 when looking at hour close. the picture with minute bars is drastic however. if you had enough margin to cover the 800 pip drop, it wouldn't have mattered. but like what OP experienced, a forced liquidation occurred. exactly what a stop hunt looks to accomplish.

the only thing required was to electronically force a recalculation of margin reqs over 5 or so minutes.

i've actually seen the spread react to my tiny positions as the algos decide to do their thing. it's very interesting to watch the minute bars.

>>

File: Here_is_the_tick_chart_of_the_flash_crash_in_the_pound.png (304KB, 990x1468px) Image search:

[Google]

304KB, 990x1468px

>>1551542

Very frequently there will be institutions with a large net short positions looking for opportunity to accumulate/buy to cover their shorts and hunting sell stops would provide them with a lot of sell market orders liquidity to buy, accumulate, cover their shorts.

Think about what kinds of stops where there below the consolidation range before the start of this: sell stop loss orders to exit longs at loss, and sell stops to get short, and shorts trailing their buys stops to cover at profit.

Every transaction has seller and a buyer. sell stops (market orders looking for buyers at any price) and funds looking to buy to cover their shorts.

The informed the funds who already knew what they where about buy to cover their shorts beforehand, and the dumb money everybody else who didnt know what was about to happen had sell stops

This is what came to mind when I first saw this crash.

I looked and found reports that show hedge funds before the crash had net short positions over 7 billion.

And this would seem to fit with perfect timing during a period with the lowest liquidity when Asia wasnt fully opened during a holiday, aggressively initiated orders to engineer lower and trigger first sell stops and within less then a minute it cascades into more and more levels of sell stops

But there are a lot of things I posted screencaps of that doesnt fit in with this idea.

Like the articles I posted quote traders at the institutional interbank level, where you can see all of the orderflow, saying there where no bids and very few offers in the orderbook, there was a period of 30 seconds where there where no quotes which means there was no market at all during that period all liquidity in orderbook had completely dried up.

>>

>>1551700

>there are a lot of things I posted screencaps of that doesnt fit in with this idea.

it's all speculation unless we can see what all the participants are doing. all was needed was an order with big size matching the asks all the way down.

learning more about the flash of 2010, it is apparent that not all algos are created equal. there was a big sell order and this particular algo sold every time the market went up. naturally, someone(s) had to take the other side of this sell with buys. eventually, the other algos absorbed so much that it set off their risk control routines. so they sold and sold and sold. even as prices dropped.

it is certain that the 2010 flash caused each firm to put in hard controls that would prevent algos from doing that again. like a 3SD move out of norm and STOP TRADING is flagged. that would explain the completely lack of liquidity on the way down for the GBP. liquidity provider/marketmakers are only around when trading is withing a normal range. otherwise they can pull their orders just like everybody else.

and the reverse would be true, play a regression once a move goes 5SD or something equally stupid. 8 cents in 5 minutes is insane. if i hadn't been at my day job and watching the GBP, i would have definitely regressed that. would have made 6 or so cents over 10minutes. and obviously we see that. it regressed into a somewhat normal trading range within 7 minutes from the flash. i usually stay away from the GBP because of its abnormally large sized moves. it's only gotten worse since brexit.

a fat finger order is possible. i still think it is more likely it was a stop hunt.

a side benefit of an actual sell on the bid would mean you would have transaction data each time your order was filled on the way down. in this manner, you would be able to see the sizes and price levels of buy orders from 1.26 to 1.18. it's a risky move but would give you market intelligence for whatever it is you're planning.

>>

File: 1463191162930.jpg (19KB, 259x253px) Image search:

[Google]

19KB, 259x253px

>>1550358

im still learning about forex dont have access to do it yet but I read that's an easy mistake to make. sorry anon. claw your way back you're probably young-ish enough to do it someday soon

>>

>>1550330

>I had long positions in GPBUSD

It's only going to proceed lower.

>>

>unhedged trading on margin

Think of this as an expensive and painful lesson in how the smaller fish get eaten by bigger fish.

>>

>gambling on the GBP going up

how dumb are you? if you bought correctly, you should be up $80k not down $40k

>>

>>1550263

What did you base your trades on, or was it just gambling?

And how old are you?

I know the feeling, but aslong as your cashflow is good from your amazon business than you are atleast good.

Is it 8-12 in turnover or revenue?

>>

>>1550263

You should mark out personal information better anon. Faggots here are smart

>>

>>1552985

no theyre not

this place is filled with retards

>>

>>1551468

>For a few moments there wasn't actually a market there.

Comforting

>>

>>1552989

Let me rephrase

"Dumb enough to actually try identity fraud."

>>

>>1552985

Even if they could hack my account, I think they would be disappointed by what they would find there. Like I said, my account has pretty much been wiped out.

>>

>>1553310

Maybe we can make some profits for a change.

>>

Buy more, wait for bounce

>>

Do you think the GBP will ever rise back to at what it was before brexit at least?

>>

>>1550905

That's an interesting goal perhaps, but I doubt it was anyone's plan. The EU would have much preferred the status quo to this. The leaders of the Brexit clearly never expected the resolution to win and had no clear plan of how to move forward after Yes, worst of all was Farage immediately stepping aside to "spend more time with the family." Coward.

>>

>>1551323

in firefox press shift+F2 and type

screenshot --fullpage

>>

>>1553542

it _should_ come back up if political leaders do what's best for their countries, but that and $.25 will buy you a gum ball. if anyone really knew where the price was headed, the price would go there now.

>>

File: Jy9Ssdt.png (97KB, 1063x700px) Image search:

[Google]

97KB, 1063x700px

>>1550372

buy the dip :^)

>>

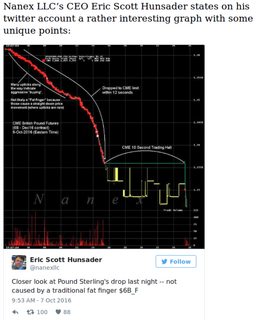

File: Nanex_not_traditional_fat_finger.png (754KB, 1511x1880px) Image search:

[Google]

754KB, 1511x1880px

>>1552263

Nanex's Hunsader says that it wasnt a traditional fat finger and that there was aggressive buying, see pic related. But he's looking at data for 6B on the CME which you know in only a small drop compared to the cash volume ocean.

I really would like to know more about this:

>a side benefit of an actual sell on the bid would mean you would have transaction data each time your order was filled on the way down. in this manner, you would be able to see the sizes and price levels of buy orders from 1.26 to 1.18. it's a risky move but would give you market intelligence for whatever it is you're planning.

I've heard people talking about how with a ECN (non market making) broker you can do stuff like working small lot orders and using the information that comes the fills to try to discern the underlying microstructure and orderflow. But people into this kind of stuff usually keep their cards close to their chest and dont describe what they are doing.

>>

>>1552263

>>1555167

Something similar seemed to happen during Brexit, here are some excepts:

>Investors are unable to trade electronically across the industry as markets have seized following a surge in trading after the UK voted to leave the EU.

>A number of platforms are unable to process investor requests to trade, as they are not receiving prices from market makers

>with market makers and brokers unable to cope with the volume of requests for trades.

>the market makers weren’t serving back any electronic quotes, so we couldn’t trade electronically and I think that is widespread across the market.”

>the platform is also experiencing problems and delays, it is an “industry-wide issue”, adding: “We can’t get prices through from the markets,so it is delaying trades.”

>there wasn’t a lot of liquidity in the market,” said the company. “The market makers weren’t giving quotes, so we weren’t able to fulfil a lot of those trades.

>inability and unwillingness of market-makers to provide liquidity. There are few bodies capable of catching the falling knife right now

>central banks are concerned that market liquidity could quickly dry up

>the Bank of England ready to step in to become a last resort market maker if necessary

>Fed Ready to Inject Liquidity as Brexit Sends Markets Into Frenzy

>Morgan Stanley’s dark pool was offline in London this morning

>Deutsche Bank AG temporarily shut off outside brokers and market makers in its dark pool

>>

File: Pound_plummet_blamed_on_‘liquidity_holes’.png (415KB, 632x3223px) Image search:

[Google]

415KB, 632x3223px

>>

>>1555167

if you have a big sell order and you keep slamming the bid down further, the support didn't come in yet. then you hit the big one. sell 10, 20, 30 million and the bid doesn't budge. that's your major support. and you promptly reverse position as fast as you can. your short average cost would still well above this and you can close for a profit. then, you ride that up and make money long. this obviously only works with massive capital.

>>1556487

it's really as i expect. the algos sensed a crazy trade environment and basically shut themselves out of participating.

btw, i'm in another thread talking about forex. are you PL?

>>

File: Pound_remains_under_pressure_as_negative_sentiment_persists.png (251KB, 628x1614px) Image search:

[Google]

251KB, 628x1614px

>>1556509

I recall hearing people who do this with less than 10mill, they somehow glean the information by placing small lots and paying great attention to every detail of the fills, but I'm not exactly sure how they do it.

Am I PL? I don't know what you mean by this, need more context.

>>

File: JPM_Explains_How_HFTs_Caused_Fridays_Sterling_Flash_Crash.png (424KB, 886x1596px) Image search:

[Google]

424KB, 886x1596px

>>1551066

>>

>>1556547

well, i don't have any where close to 10 mill liquid to trade. but you can definitely sense when the bids are going up. i'm getting a lot better at not paying the spread to get into a trade. it's possible these pro traders are running algos of their own and paying attention to 1/10th of pips on their fills.

you are not PL. that's the guy's initials. it's cool bro.

>>

>>1550263

Why didn't you put it into alternative crypto coins? Lol

>>

File: How_to_profit_from_tape,_order_flow_and_order_book_reading_in_a_Flash_Crash.png (535KB, 982x2641px) Image search:

[Google]

535KB, 982x2641px

>>1556560

there is another thread talking about this kind of stuff? what thread is it?

>>

>>1556592

there was some forex discussion within the thread. it's not much.

btw, do you trade forex or just watch?

>>

>>1556610

I haven't yet traded, and am just a student of the markets, observing and learning. You could spot that?

>>

>>1556646

>You could spot that?

spot what?

>>

>>1556656

I was curious and wondering why you are asking.

>>

>>1556665

if you're going to learn a great deal about any given subject, you may as well learn how to be profitable from it.

>>

>>1550303

I've looked into it. It's not looking like a fat finger. It's more like a cascade of HFT algorithms getting out and staying out, which lead to a total lack of liquidity in cable.

>>

>>1556670

Lots of steps to take first, a lot to learn, and a lot of skills that need to be developed and practiced, before I get there.

Thread posts: 95

Thread images: 23

Thread images: 23